IPC Email Template: USI Proxy Followup EmailStatement Pursuant to Section 14(a) of the

Subject Line: Please Vote: Upcoming Mutual Fund Shareholder Meeting andSecurities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a party other than the Registrant [ ]

Check the appropriate box:

// Preliminary Proxy VoteStatement

We recently sent you proxy materials concerning important proposals affecting your // Definitive Proxy Statement

/X/ Definitive Additional Materials

// Soliciting Material pursuant to Rule 14a-11(c) or Section Rule 14a-12

// Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e) (2))

T. Rowe Price fund(s). The proposals will be considered at an upcoming joint special shareholder meeting on July 25, 2018. The proposals include the election of new directors of the funds’ boards, as well as investment objective and/or policy changes for various Blue Chip Growth Fund, Inc. 033-49581/811-7059

T. Rowe Price funds.Equity Funds, Inc. 333-04753/811-07639

As the date of the shareholder meeting approaches, we have not yet received the required votes on the two proposals below and are asking our clients to please vote their shares as soon as possible. Our records indicate that we have not yet received your vote.

·Amend the fundamental policy on commodities of nine funds

The proposed policy is intended to clarify the funds’ authority to enter into a variety of derivative transactions relating to commodities and would essentially “modernize” the current policy, which only discusses commodity-related futures and options. Under the proposed policy, the term “physical commodities” would be changed to “commodities,” but direct investments in commodities would still be prohibited. This change would align the funds’ policy on commodities with other T. Rowe Price funds.Equity Series, Inc. 033-52161/811-07143

· ReclassifyT. Rowe Price Exchange-Traded Funds, Inc. 333-235450/811-23494

T. Rowe Price Global Funds, Inc. 033-29697/811-5833

T. Rowe Price Growth Stock Fund, Inc. 002-10780/811-579

T. Rowe Price International Funds, Inc. 002-65539/811-2958

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement)

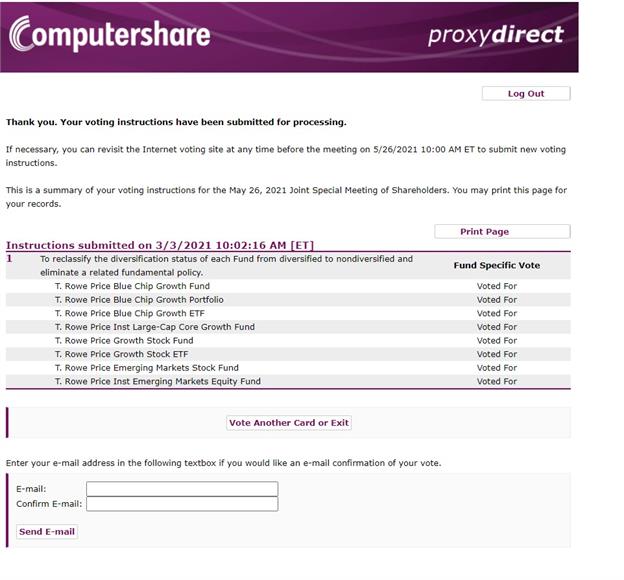

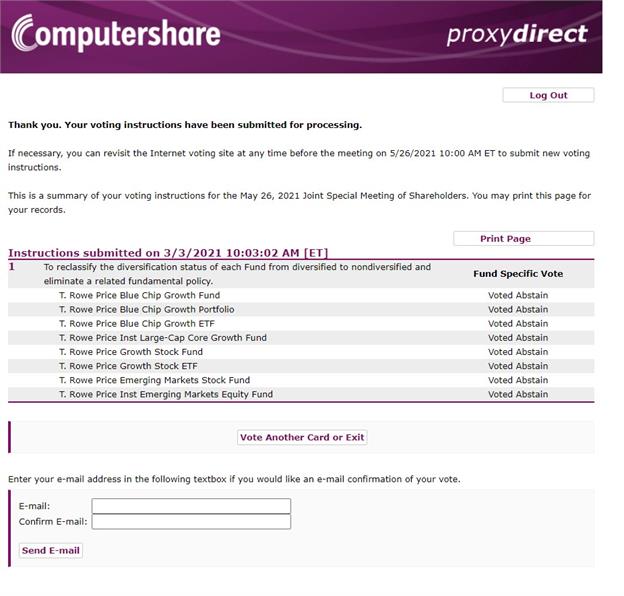

Payment of Filing Fee (Check the diversification status of ten sector funds from diversified to nondiversified

Sector funds tend to have more concentrated benchmarks with limited investable opportunity sets. The proposed change to each fund’s diversification policy will provide each sector fund with greater flexibility, but will not substantially affect the way each fund is managed.

YOUR FUND’S BOARD RECOMMENDS THAT YOU VOTE "FOR" EACH PROPOSAL

For more information on the shareholder meeting, including information on the specific proposals, please review the proxy materials by clicking here.

To vote your shares, please call Computershare, our proxy solicitor, at 1 (866) 436-5968. Specialists can assist with questions and voting and are available Monday-Friday from 9 a.m. – 11 p.m. ET and Saturday from 12 p.m. – 6 p.m. ET.

We appreciate your continued business and partnership. If you have any additional questions, please feel free to contact us.

Regards,appropriate box):

[Insert Sales Associate NameX] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i) and Outlook Signature]0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

This communication does not undertake3) Per unit price or other underlying value of transaction computed pursuant to give investment advice in a fiduciary capacity. T. Rowe Price Associates, Inc., and/Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined:

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and

identify the filing for which the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the form or schedule and the date of its affiliates receive revenue from T. Rowe Price investment products and services.filing.

Download a Prospectus1) Amount previously paid:

All funds are subject to market risk including possible loss of principal.

This email may be considered advertising under federal law.2) Form, schedule, or Registration Statement no.:

100 E. Pratt Street, Baltimore, MD 21202

To modify your email options or opt out of receiving e-communications from U.S. Investment Services of T. Rowe Price, click here.3) Filing party:

T. Rowe Price Investment Services, Inc.

For Institutional Investor Use Only. Not For Further Distribution.4) Date filed:

201807-547223